A Los Angeles SIU Guide: When to Use Surveillance vs. Behavioral Interviews in High Risk Claims

A Los Angeles SIU Guide: When to Use Surveillance vs. Behavioral Interviews in High Risk Claims

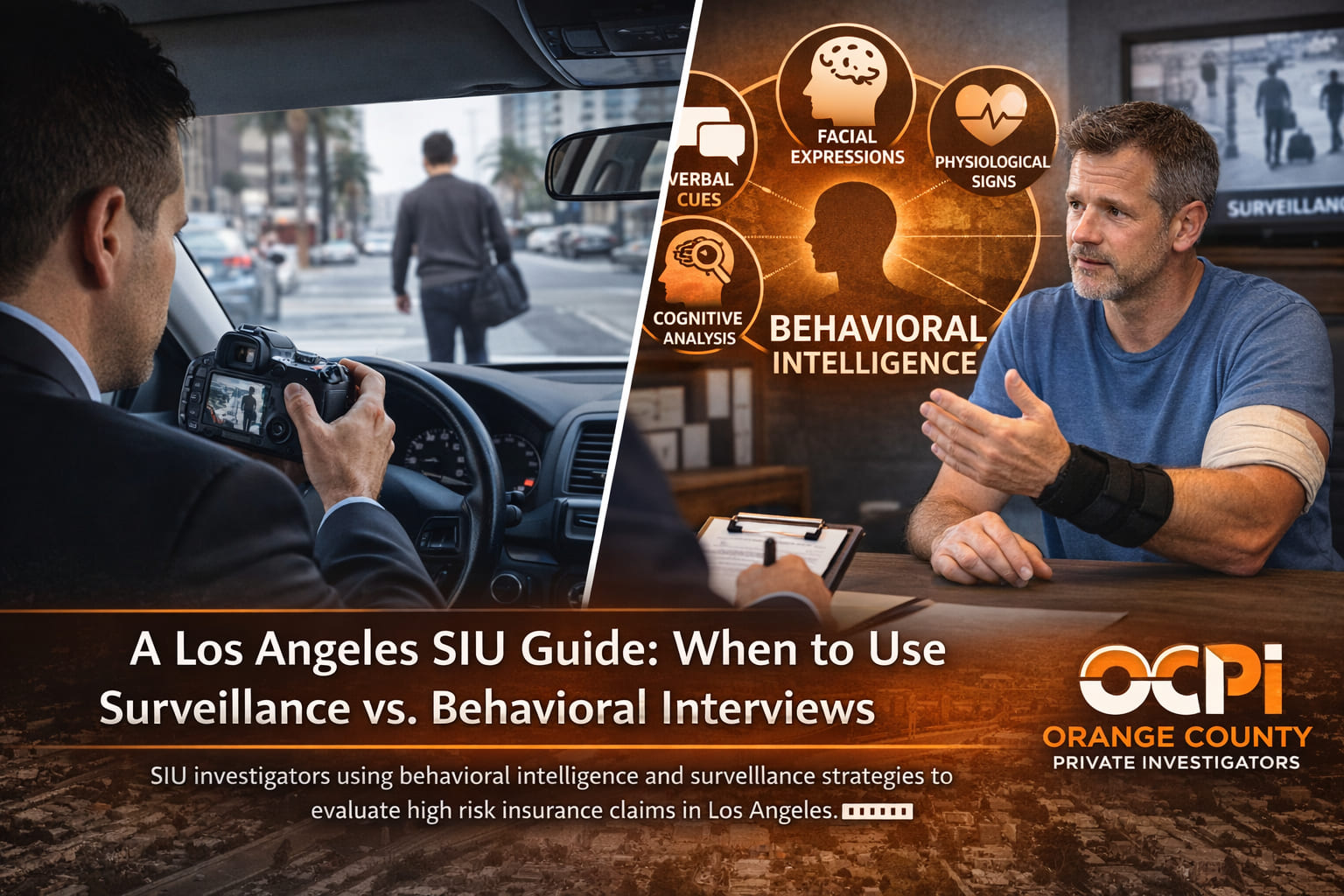

Los Angeles is one of the most challenging regions in the country for insurance fraud detection. The city’s dense population, wide range of industries, and high volume of complex claims require SIU teams to operate with precision and strategy. Surveillance remains a powerful investigative tool, but it is costly and unpredictable. Behavioral intelligence interviews offer deep insight into claimant credibility, but they do not replace visual proof.

The key for Los Angeles SIU teams is knowing when each investigative method delivers the highest value in a high risk claim.

When used correctly, behavioral interviews and surveillance complement each other, producing stronger documentation, clearer claim direction, and significantly lower wasted investigative spend.

Why Los Angeles Requires a Different SIU Strategy

Los Angeles presents investigative challenges that are far more complex than many other regions. SIU teams regularly face:

- Dense urban environments that limit clean surveillance opportunities

- Claimants who are highly informed about investigative tactics

- Higher levels of attorney involvement early in the claim

- A high frequency of soft tissue and subjective injury claims

- Cultural and communication differences that affect interviews

- Large medical provider networks with inconsistent credibility

Because of these conditions, Los Angeles SIU teams cannot rely on a single investigative tool. Behavioral indicators are often necessary to determine whether surveillance will be effective or whether human driven interviewing should guide the claim.

What Behavioral Intelligence Interviews Reveal That Surveillance Cannot

Behavioral intelligence interviewing evaluates claimant behavior across five scientifically supported channels: verbal, nonverbal, emotional, cognitive, and physiological. Instead of simply documenting statements, investigators assess the credibility behind the narrative.

Behavioral interviews can reveal:

- Inconsistencies that paperwork does not expose

- Rehearsed or fabricated injury narratives

- Avoidance patterns tied to liability or secondary gain

- Exaggeration of symptoms or limitations

- Emotional responses that contradict the claimed experience

- Behavioral spikes when sensitive topics are discussed

In Los Angeles claims, where injuries are often subjective and easily exaggerated, behavioral intelligence provides clarity early in the investigation.

When Behavioral Interviews Should Be Used First

There are several high risk claim scenarios in Los Angeles where behavioral interviews should precede surveillance:

- Soft tissue injury claims with minimal objective findings

- Claims involving vague or inconsistent injury narratives

- Mechanisms of injury that do not align with job duties

- Claimants who appear overly prepared or rehearsed

- Allegations following workplace disputes or discipline

- Delayed injury reporting

- Extensive prior injury or claim history

- Cases with few witnesses or unclear timelines

Starting with behavioral intelligence allows SIU teams to determine:

- Whether surveillance is justified

- What activities should be targeted

- When surveillance is most likely to succeed

- Whether alternative investigative steps are more effective

This approach significantly reduces wasted surveillance hours, one of the largest cost drivers in SIU investigations.

When Surveillance Delivers Greater Value

There are situations where surveillance should be the primary investigative step. These include:

- Claims involving suspected physical exaggeration

- Cases with social media activity showing normal function

- Situations where the claimant may be working while collecting benefits

- Claimants with documented prior fraudulent behavior

- Refusal or resistance to interviews

- Reports of inconsistent behavior from employers or neighbors

Surveillance is most effective when there is reason to believe the claimant’s physical activity contradicts the reported injury. Without behavioral guidance, however, surveillance may be poorly timed or yield no useful results.

How Behavioral Intelligence Improves Surveillance Outcomes

Behavioral intelligence does not replace surveillance. It makes surveillance more strategic.

A well conducted behavioral interview can identify:

- Signs that physical capability is being concealed

- Activities the claimant avoids discussing

- Times of day associated with stress or discomfort

- Emotional reactions tied to work, home, or recreation

- Indicators of active misrepresentation

This information helps surveillance teams focus on:

- Optimal observation times

- High value locations

- Activities most likely to expose exaggeration

- Days when the claimant is most active

The result is stronger footage, fewer wasted field hours, and better investigative return.

Why Combining Both Methods Is Essential in High Risk Los Angeles Claims

Fraud in Los Angeles is often subtle and coordinated. Rarely does a single investigative tool uncover the full truth.

A combined approach provides:

- Behavioral insight into claimant credibility

- Visual evidence supporting or disproving exaggeration

- Stronger documentation for litigation and claim defense

- Targeted surveillance deployment

- Clear justification for investigative spend

- Faster and more confident claim direction

In high risk claims, behavioral interviewing and strategically guided surveillance together produce outcomes that neither method can achieve alone.

Strengthening High Risk Claim Decisions in Los Angeles

Los Angeles SIU teams operate in one of the most complex fraud environments in the country. Knowing when to deploy behavioral interviews versus surveillance is critical for accuracy, cost control, and defensible outcomes.

Behavioral intelligence reveals the truth behind the claimant’s story. Surveillance provides the visual confirmation needed for decisive action. Together, they form a modern investigative strategy designed for high risk claims in Los Angeles.

Learn more about our insurance investigation services:

https://ocprivateinvestigators.com/insurance-investigations/

Request a confidential SIU consultation: