How Behavioral-Intelligence Interviews Are Transforming Workers’ Comp Investigations in Orange County

How Behavioral-Intelligence Interviews Are Transforming Workers’ Comp Investigations in Orange County

Workers’ compensation claims in Orange County have grown increasingly complex as employers, insurers, and claims professionals balance accuracy with efficiency. According to the California Division of Workers’ Compensation, claim volume and dispute complexity continue to place pressure on carriers to resolve files quickly while maintaining defensibility.

Traditional investigative tools such as surveillance, background checks, and document reviews remain essential, but they often provide only a partial view of what is truly happening inside a claim. Industry data from the National Insurance Crime Bureau shows that modern insurance fraud is increasingly subtle, rehearsed, and behaviorally sophisticated.

That reality is why behavioral-intelligence interviewing has become a critical tool in modern workers’ comp investigations.

Why Traditional Workers’ Comp Methods Miss Key Red Flags

Workers’ comp investigators and adjusters often encounter limitations when relying solely on administrative or observational tools. These methods fall short because:

- Paperwork cannot reliably reveal intent or exaggeration

- Surveillance often produces no usable evidence when claimants modify behavior

- Database records show history, not credibility

- Rehearsed statements may appear consistent but lack behavioral authenticity

- Subjective injuries such as soft-tissue claims are difficult to objectively disprove

The Workers’ Compensation Insurance Rating Bureau of California has consistently reported that soft-tissue injuries and delayed reporting contribute significantly to disputed claims and extended investigation timelines.

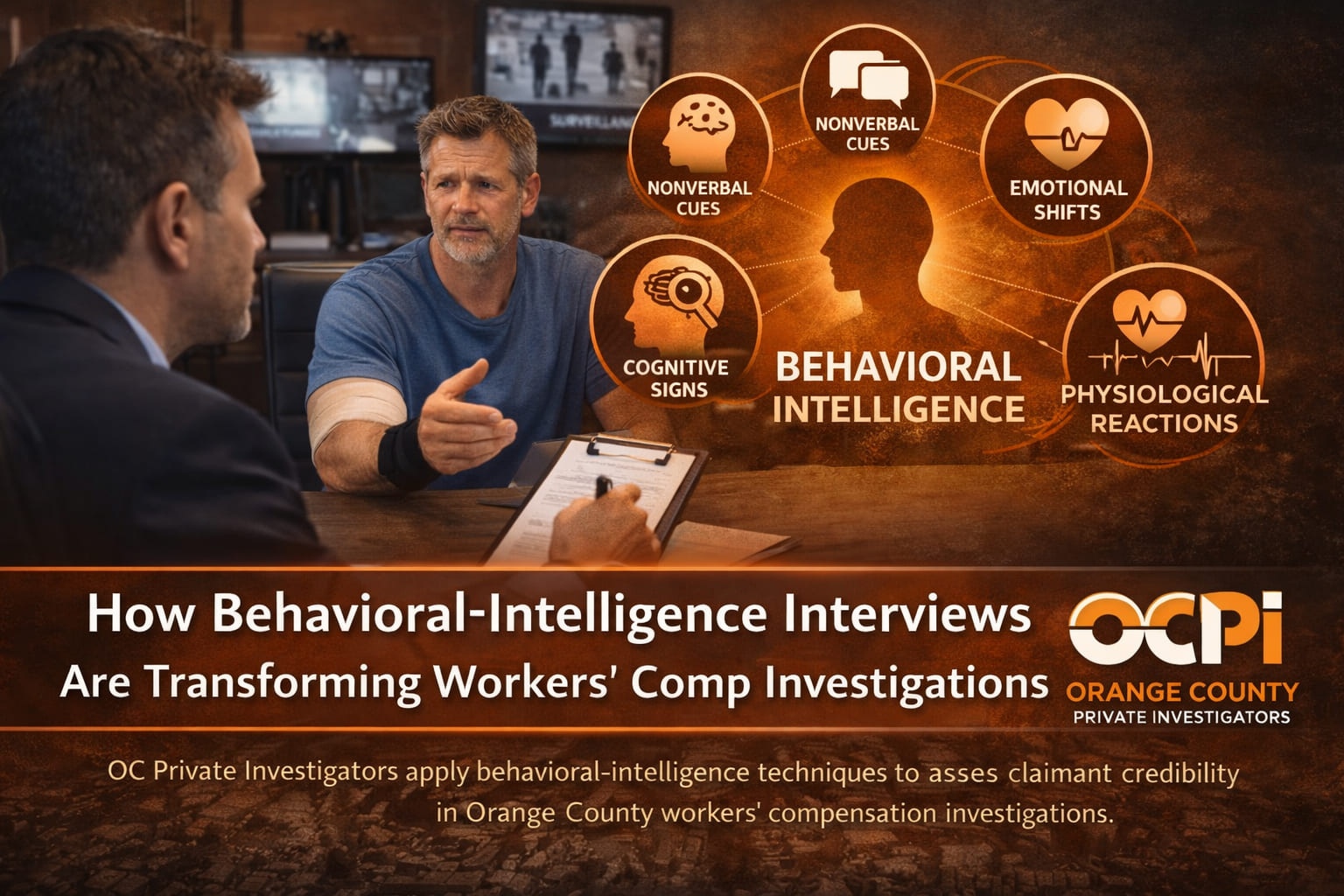

What Behavioral-Intelligence Interviews Measure

Behavioral-intelligence interviewing evaluates claimant behavior across five scientifically supported channels:

- Verbal indicators such as structure, pacing, and consistency

- Nonverbal cues including posture, micro-expressions, and tension

- Emotional shifts that occur during sensitive discussions

- Cognitive signs like over-rehearsal or recall difficulty

- Physiological reactions such as breathing changes or hesitation

Behavioral analysis techniques are supported by decades of research in investigative interviewing and credibility assessment, including methods outlined by the FBI Law Enforcement Bulletin.

Why Behavioral Analysis Improves AOE and COE Accuracy

AOE and COE determinations rely heavily on the clarity and plausibility of the claimant’s account. Behavioral interviewing provides insight into:

- Whether the injury mechanism is logically plausible

- Whether symptoms align with the incident description

- Whether non-work factors influence the claim

- Whether cognitive strain appears during key recollections

- Whether indicators of secondary gain are present

This behavioral layer supports faster, more defensible compensability decisions, particularly in high-volume regions like Orange County.

Reducing Unnecessary Surveillance and Lowering Costs

Surveillance remains one of the most expensive investigative tools in workers’ comp. Behavioral interviews help SIU teams determine when surveillance is likely to be productive, reducing unnecessary spend and improving investigative ROI.

As noted by the Insurance Information Institute, targeted investigations that combine behavioral indicators with field work consistently outperform surveillance-only approaches.

Why Orange County Benefits Strongly From Behavioral Interviewing

Orange County’s workforce includes logistics, construction, hospitality, and service industries where soft-tissue injuries are common. High cost-of-living pressure and frequent job movement increase the likelihood of exaggerated or disputed claims.

Behavioral interviewing provides insurers with earlier clarity, stronger documentation, and better litigation support in this environment.

Strengthening Workers’ Comp Decisions With Behavioral Intelligence

Behavioral-intelligence interviewing brings clarity where paperwork and observation alone fall short. When applied early, it reduces fraud exposure, shortens claim timelines, and strengthens decision defensibility.

Learn more about our insurance investigation services:

https://ocprivateinvestigators.com/insurance-investigations/

Request a confidential consultation: